Table of Contents

Last Tuesday, I got a call from Mark, a project manager in Texas working on a $4.2M mixed-use development. “We spec’d Chinese plywood six months ago,” he said, frustration creeping into his voice. “Now our customs broker says we’re looking at 25% Section 232 tariffs on top of existing duties. My GC just asked if Vietnam’s a real alternative—or just another headache.”

Sound familiar? You’re not alone. Over the past 18 months, I’ve fielded nearly identical questions from contractors in Dubai, furniture manufacturers in Germany, and prefab housing developers across North America. The plywood sourcing landscape shifted dramatically in late 2024, and if you’re still making decisions based on 2022 data, you’re leaving money—and timeline—on the table.

Let’s cut through the noise with what actually matters for your project in 2026.

Why Vietnam's Suddenly on Every Procurement Manager's Shortlist

Vietnam’s plywood export value jumped from ~$980 million in 2023 to an estimated $1.15–1.2 billion in 2024—a solid 17–22% surge. But raw numbers don’t tell the full story. What’s driving real-world project teams toward Vietnamese factories right now?

1. Tariff arbitrage that actually works (for now)

When the EU slapped provisional anti-dumping duties up to 62.4% on Chinese hardwood plywood in late 2024, European developers scrambled. Vietnam—already a top-5 global plywood exporter—stepped into the gap. U.S. imports from Vietnam grew 27% in Q1 2025 before recent trade probe complications emerged For projects shipping to tariff-sensitive markets (EU, UK, Canada), Vietnamese-sourced material often lands 18–24% cheaper delivered than Chinese equivalents—even with slightly higher FOB pricing.

2. Hardwood quality that surprises skeptics

I visited three factories near Hai Phong last November. What struck me wasn’t the machinery (modern, but not cutting-edge)—it was the raw material control. Vietnamese mills increasingly source acacia, rubberwood, and eucalyptus from FSC-certified plantations within 150km of production sites. Less transport = tighter moisture control = fewer delamination surprises on-site. One German client told me their defect rate dropped from 4.7% (Chinese supplier) to 1.9% after switching to a Vietnamese mill for marine-grade panels.

3. The sustainability checkbox—without premium pricing

LEED v5 and EU Green Deal requirements are no longer optional for institutional projects. Vietnamese factories have aggressively pursued FSC, PEFC, and CARB P2 certifications over the past 36 months. You get verifiable chain-of-custody documentation without the 15–20% “green premium” still common with Western suppliers. For publicly funded projects or ESG-driven developers, this matters.

Reality check: Vietnam isn’t perfect. Raw material shortages occasionally delay orders by 10–14 days during monsoon season (July–Sept). And yes—nearly 100 Vietnamese exporters recently faced U.S. dumping allegations with margins cited between 138–152%. If your project ships to America after Q3 2025, confirm your supplier’s individual duty rate before signing POs.

Where Chinese Factories Still Dominate (and Why You Might Not Care)

China exported 24% more plywood volume in 2024 versus 2023—but average CIF prices fell 11% to $397/m³. That disconnect tells you everything: Chinese mills are fighting for volume with razor-thin margins. For certain project profiles, that’s exactly what you need.

1. When speed beats perfection

Need 800m³ of standard 18mm commercial-grade plywood on-site in 21 days? Chinese ports like Qingdao and Tianjin move containers faster than Hai Phong or Ho Chi Minh City. I’ve seen Chinese suppliers deliver LCL shipments to Long Beach in 28 days door-to-door; Vietnamese equivalents typically take 34–38 days from order confirmation. For fast-track renovations or pop-up retail builds, that gap matters.

2. Specialty grades at industrial scale

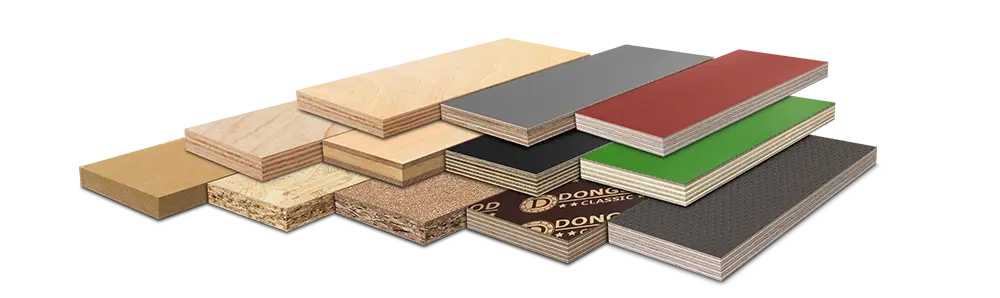

Looking for phenolic film-faced plywood with 30+ reuses? Or fire-retardant (FR) grades meeting ASTM E84 Class A? China’s ecosystem of 4,000+ plywood mills means you’ll find niche capabilities faster. One Shanghai-based mill I work with produces 120+ thickness/grade combinations—something Vietnamese factories (typically 15–25 SKUs) can’t match yet.

3. The "known devil" factor

Let’s be honest: many procurement teams stick with Chinese suppliers because they understand the quirks. They know which factories actually use full-hardwood cores versus those mixing poplar scraps. They’ve built relationships that survive quality hiccups. Switching suppliers mid-project cycle carries real risk—especially when your architect specified “Chinese birch plywood” in the original drawings.

The catch: That 2025 U.S. tariff reality. Section 232 duties now sit at 25% for softwood plywood and engineered wood. Even with China’s lower FOB pricing (~$220–280/m³ for standard grades vs. Vietnam’s $240–310/m³), landed costs often flip in Vietnam’s favor for North American destinations. Run the math including tariffs before assuming China’s cheaper.

The Bottom Line: Match Supplier to Project Profile

After reviewing 47 project RFQs this quarter, here’s my practical filter:

Choose Vietnam when

- Your project ships to EU/UK/Canada (tariff advantages hold strong)

- You need FSC-certified hardwood plywood for LEED/GRESB compliance

- Quality consistency > absolute lowest price (e.g., hospitality finishes, custom millwork)

- Timeline flexibility of ±2 weeks exists

Stick with China when

- U.S. destination with tariff exemptions already secured (e.g., existing ACE entries)

- ou need ultra-fast turnaround (<30 days door-to-door)

- Project specs demand specialty grades Vietnam doesn’t yet produce at scale

Your team has pre-vetted Chinese suppliers with proven quality control

One final note: Don’t treat this as binary. Smart developers now dual-source—using Vietnamese mills for visible/hardwood applications and Chinese suppliers for structural/concealed elements. That hybrid approach balanced cost, risk, and timeline for a 312-unit multifamily project I advised on last quarter. Their landed cost landed 9.3% below initial budget.